The phrase "resident alien instruction manual" might conjure up images of a quirky sci-fi comedy, perhaps starring an extraterrestrial trying to blend into human society. While the popular Syfy series "Resident Alien," featuring Alan Tudyk as the stranded Dr. Harry Vanderspeigle, certainly provides a humorous take on an alien's attempt to understand Earth's bewildering customs, the reality of being a "resident alien" on our planet is far less about shapeshifting and much more about navigating a complex web of legal and financial obligations. This comprehensive guide aims to be your essential instruction manual, demystifying the critical information real-world resident aliens need to thrive, ensuring compliance and peace of mind.

Beyond the realm of television, the term "resident alien" carries significant weight, particularly in the United States, where it defines an individual's tax status and eligibility for various programs. For those living in a place for some length of time but not yet holding full citizenship, understanding the specific guidelines and requirements is not merely helpful; it's absolutely crucial. This article delves into the true "instruction manual" for resident aliens, covering everything from tax responsibilities to government benefit verification, providing clarity on a topic that directly impacts financial well-being and legal standing.

What Exactly is a "Resident Alien"? Defining the Term Beyond Pop Culture

The meaning of "resident" is, at its core, living in a place for some length of time, or simply a person who lives or has their home in a place. However, when combined with "alien," the term takes on a specific legal and tax-related definition, particularly within the United States. A resident alien is not a citizen or national of the U.S. but is considered a resident for tax purposes or due to their immigration status, such as holding a green card.

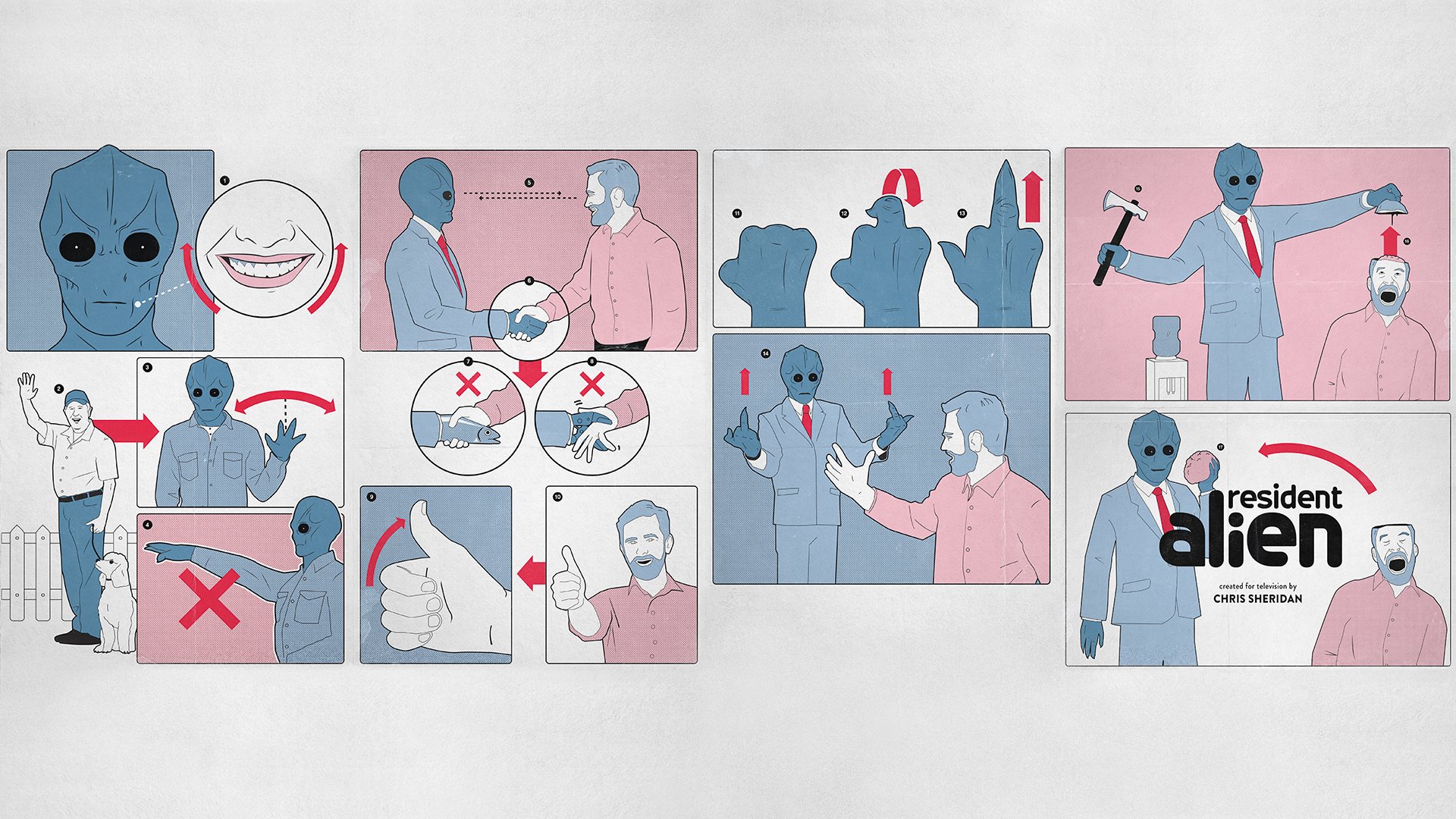

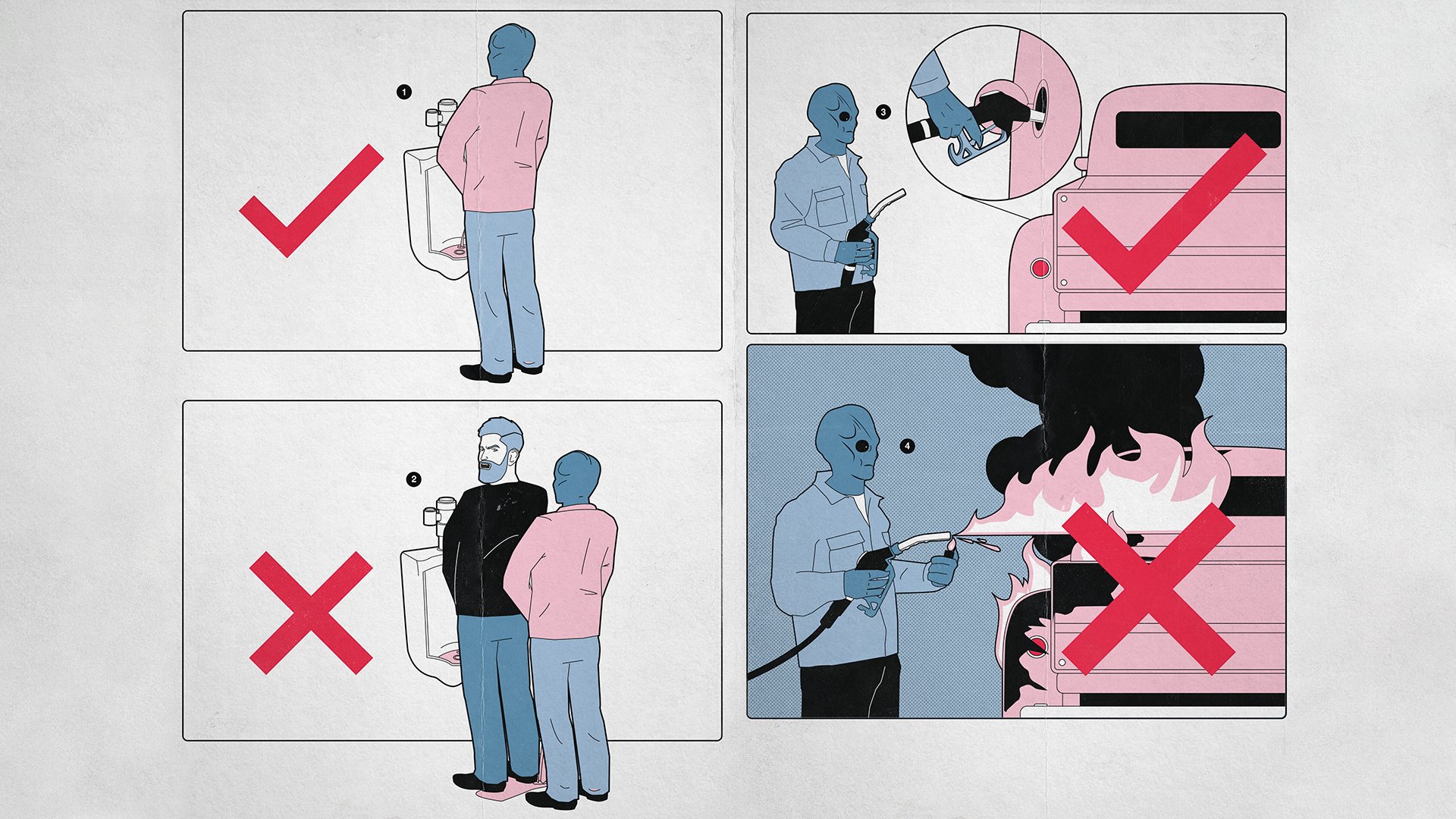

This is where the popular culture reference, like the hilarious comedy about an alien stranded on Earth, "Resident Alien," starring Alan Tudyk as Dr. Harry Vanderspeigle, often creates a playful misunderstanding. While that show explores the comedic challenges of an extraterrestrial trying to pass as human, the real-world "resident alien" faces a different, albeit equally complex, set of challenges rooted in legal compliance and financial responsibility. Understanding this distinction is the first crucial step in grasping the true scope of any "resident alien instruction manual."

For tax purposes, an individual is generally considered a resident alien if they meet either the "green card test" or the "substantial presence test." The green card test is straightforward: if you are a lawful permanent resident of the U.S. at any time during the calendar year, you are a resident alien. The substantial presence test is more complex, involving a calculation of days spent in the U.S. over a three-year period. Meeting either of these criteria means you are treated as a U.S. resident for tax purposes, subjecting you to the same tax rules as U.S. citizens.

The Unseen Manual: Understanding U.S. Tax Obligations for Resident Aliens

For many, the most critical section of any real-world "resident alien instruction manual" concerns taxation. Unlike non-resident aliens who are generally only taxed on U.S.-sourced income, resident aliens are typically taxed on their worldwide income, just like U.S. citizens. This means income earned anywhere in the world – whether from employment, investments, or other sources – must be reported to the Internal Revenue Service (IRS).

The "U.S. Tax Guide for Aliens," a document that has seen various iterations over the years (such as the 1998 version mentioned in our data), serves as a foundational component of this "instruction manual." While specific forms and regulations evolve, the core principle remains: compliance is non-negotiable. Failing to properly understand and fulfill these obligations can lead to severe penalties, including fines and even deportation, underscoring the YMYL (Your Money or Your Life) nature of this information.

Recognizing the ways to acquire this "ebook resident alien instruction manual" – typically found on official government websites – is additionally useful. These guides provide detailed information on everything from filing status to deductions and credits. The complexity often necessitates a thorough understanding of U.S. tax law, which can be daunting for newcomers. This is why many resident aliens seek professional assistance to ensure accuracy and compliance, embodying the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) in their approach to financial matters.

Navigating the Tax Labyrinth: Key Forms and Deadlines

The U.S. tax system is renowned for its intricacy, and for resident aliens, understanding which forms to file and by when is paramount. Generally, resident aliens will file Form 1040, the same income tax return form used by U.S. citizens. However, there may be additional forms or schedules depending on specific circumstances, such as foreign income, assets, or specific visa types.

For instance, while the data mentions the IT NRC form used to calculate the nonresident credit on the Ohio return, it's crucial to remember that these forms are specific for each tax year, so make sure you are using the correct form. This highlights the importance of staying updated with current tax laws and publications. Resources like the "Sprintax Calculus Instruction Manual 1.2" mentioned in the data, or similar tax preparation software and guides, aim to simplify the process, often providing quick search options for completing residency information for tax purposes.

Key deadlines are typically April 15th for most individual filers, though extensions can be requested. However, international considerations can sometimes alter these dates. The process of collecting all information relating to your residency for tax purposes is the initial step, followed by meticulous preparation and filing. This attention to detail is a cornerstone of responsible financial management for any resident alien.

The SAVE Program: A Vital "Instruction Manual" for Benefit Verification

Beyond taxes, another critical component of the "resident alien instruction manual" pertains to the Systematic Alien Verification for Entitlements (SAVE) program. This program is a crucial tool used by federal, state, and local government agencies to verify the immigration status of applicants for public benefits. The "Systematic Alien Verification for Entitlements (SAVE) Program User Manual," with versions from 2000 and 1998 referenced in our data, serves as the operational guide for agencies utilizing this system.

For resident aliens, while they don't directly use the SAVE manual, its existence profoundly impacts their lives. When applying for benefits such as Social Security, Medicaid, or housing assistance, their immigration status will likely be verified through the SAVE program. This means that maintaining accurate and up-to-date immigration records is an indirect but vital part of their "instruction manual." The program ensures that only eligible individuals receive benefits, upholding the integrity of public assistance programs.

Understanding that such a system exists and how it operates provides resident aliens with insight into the verification processes they may encounter. It reinforces the importance of possessing valid documentation and ensuring that their legal status is correctly reflected in government databases. This aspect of the "resident alien instruction manual" is less about what to do, and more about what to expect when interacting with government services, emphasizing transparency and compliance.

Beyond Taxes and Benefits: Other "Instruction Manual" Aspects of Resident Alien Life

While taxes and benefit verification are paramount, the "resident alien instruction manual" extends to numerous other facets of daily life. Living in a place for some length of time involves more than just financial obligations; it encompasses integrating into society and navigating everyday systems. This includes:

- Driver's Licenses and State IDs: Obtaining proper identification is essential for countless activities, from opening bank accounts to proving age. Each state has specific requirements for resident aliens.

- Social Security Numbers (SSN): For employment and tax purposes, an SSN is usually required. Understanding the application process and its importance is a key step.

- Banking and Financial Services: Setting up bank accounts, applying for credit cards, and understanding credit scores are vital for financial stability and participation in the economy.

- Employment Authorization: Ensuring one has the legal right to work in the U.S. is fundamental. The type of visa or immigration status dictates work authorization.

- Maintaining Legal Status: This is perhaps the most critical ongoing "instruction." Resident aliens must adhere to the conditions of their visa or green card, including avoiding certain activities, renewing documents, and notifying authorities of changes in address. Failure to do so can jeopardize their legal status and future in the U.S.

- Path to Citizenship: For many resident aliens, the ultimate goal is U.S. citizenship. The "instruction manual" for this journey involves meeting residency requirements, demonstrating good moral character, passing civics and English tests, and successfully navigating the naturalization process.

Each of these areas has its own implicit "instruction manual" – a set of rules, forms, and procedures that resident aliens must learn and follow. The collective understanding of these guidelines forms a comprehensive guide for living successfully and legally in the United States.

Seeking Expert Guidance: Why You Can't DIY Your "Resident Alien Instruction Manual"

Given the complexity and the YMYL implications of being a resident alien, relying solely on self-interpretation of official documents, even those titled "resident alien instruction manual," can be risky. The nuances of immigration law and tax codes are vast and frequently updated. This is where the principles of E-E-A-T become paramount: seeking out and trusting expert advice is not just recommended, it's often essential.

For immigration matters, consulting a qualified immigration attorney is invaluable. They can provide accurate, up-to-date information on visa requirements, green card processes, citizenship applications, and any potential pitfalls. Similarly, for tax obligations, a Certified Public Accountant (CPA) or a tax professional specializing in international taxation can ensure accurate filing, identify eligible deductions, and help avoid costly mistakes. These professionals are the living, breathing "instruction manuals" with the expertise and authority to guide you through the intricacies.

The phrase "you have remained in right site to start getting this info" might apply to finding general information, but for personalized, actionable advice on your specific situation, direct consultation with experts is irreplaceable. This proactive approach safeguards your financial well-being and legal standing, preventing issues that could severely impact your life.

The Role of Digital Resources and Official Guides

While professional advice is crucial, official digital resources serve as foundational "instruction manuals." Websites for the IRS (Internal Revenue Service) and USCIS (U.S. Citizenship and Immigration Services) are primary sources for current forms, publications, and guidelines. Publications like the "Tax Guide for Aliens" are continually updated and available online, often in PDF format, making them easily accessible. These resources are designed to be comprehensive and authoritative, providing the baseline information for understanding your obligations as a resident alien.

Furthermore, many organizations and educational institutions offer resources specifically tailored for international students and foreign nationals, providing simplified guides and workshops. These can be excellent starting points for understanding the basics before diving into the more complex aspects with a professional. The key is to always cross-reference information with official government sources to ensure accuracy and timeliness.

Pop Culture's "Residents": A Brief Detour

It's fascinating how the word "resident" takes on such varied meanings, from the legal and tax-related "resident alien" to its uses in entertainment. Before we conclude our deep dive into the practical "resident alien instruction manual," let's take a brief detour into the pop culture references that often spring to mind when discussing "residents."

One prominent example is "The Resident," an American medical drama television series that aired on FOX from January 21, 2018, to January 17, 2023. Created by Amy Holden Jones, Hayley Schore, and Roshan Sethi, this series follows the personal and professional lives of residents, attendings, and other staff members at the fictional Chastain Park Memorial Hospital. In this context, a "resident" refers to a doctor who is still training, typically after graduating from medical school. The show, featuring a cast including Matt Czuchry (Dr. Conrad Hawkins), Andrew McCarthy, and Kaley Ronayne, provides a dramatic look into the demanding world of medical training, highlighting the challenges and triumphs faced by these doctors. The "Welcome to The Resident Wiki" serves as a free repository about the series, offering insights into its characters and storylines, including the cast of "The Resident" sharing their thoughts on the finale of season 5.

Then, of course, there's "Resident Alien," the science fiction comedy television series adapting the comic book of the same name. This show, starring Alan Tudyk as Dr. Harry Vanderspeigle, offers a hilarious comedy about an alien stranded on Earth who tends to observe and mimic human behavior. Promotional stills released for season 1 and promotional ad images released on social media such as Twitter, along with images and video related to the Syfy series, highlight its comedic premise. It’s a delightful exploration of what it means to be an "alien" trying to understand an "instruction manual" for human life, albeit in a highly fictionalized and humorous way.

These series, while entertaining, serve as a stark contrast to the real-world implications of the term "resident alien." They remind us that while fiction can playfully explore the concept of "living in a place for some length of time" with an otherworldly twist, the actual experience for human resident aliens is grounded in tangible legal and financial responsibilities that require a very real and comprehensive "instruction manual."

Staying Compliant: The Ongoing Journey of a Resident Alien

The "resident alien instruction manual" is not a static document that you read once and then put away. It's a living guide that requires continuous attention and adaptation. Laws change, personal circumstances evolve, and new requirements may emerge. Therefore, staying compliant is an ongoing journey that demands vigilance and proactive engagement.

This means regularly checking official government websites for updates, reviewing your personal situation annually, and not hesitating to seek professional advice when in doubt. Whether it's changes to tax codes, immigration policies, or benefit eligibility, being informed is your best defense against potential issues. The commitment to understanding and adhering to these guidelines is a testament to an individual's responsibility and desire to contribute positively to their new home.

The journey of a resident alien is one of adaptation, learning, and compliance. By embracing the spirit of the "instruction manual" – understanding the rules, seeking guidance, and staying informed – individuals can navigate the complexities with confidence and build a stable, prosperous life in their adopted country.

Conclusion

The concept of a "resident alien instruction manual" transitions from a comedic sci-fi premise to a vital, real-world necessity for those living as resident aliens. We've explored how this "manual" encompasses critical aspects of U.S. life, from the intricate world of taxation, governed by guides like the "U.S. Tax Guide for Aliens," to the essential verification processes of programs like SAVE, and myriad other daily considerations.

Understanding your status, fulfilling your tax obligations, and navigating legal requirements are not merely bureaucratic hurdles; they are fundamental pillars of your financial and legal well-being in the United States. While pop culture offers entertaining interpretations of "residents" and "aliens," the true "resident alien instruction manual" demands a serious, informed approach, emphasizing the YMYL nature of these topics.

Therefore, we strongly encourage all resident aliens to take an active role in understanding these guidelines. Do not hesitate to consult with qualified immigration attorneys and tax professionals. Their expertise is an invaluable resource, ensuring you remain compliant and confident in your journey. Share this article with anyone who might benefit from this comprehensive guide, and feel free to leave your questions or experiences in the comments below. Staying informed and seeking expert advice is the ultimate instruction for a successful life as a resident alien.

Detail Author:

- Name : Teresa Koss IV

- Username : danika88

- Email : gaylord.wilkinson@hotmail.com

- Birthdate : 1975-06-20

- Address : 881 Lori Landing Apt. 986 Port Faustofurt, AL 99529

- Phone : 1-954-761-4934

- Company : Pacocha Group

- Job : Substance Abuse Counselor

- Bio : Error est quas voluptas vero voluptates explicabo aut. Sed fugiat autem et impedit et quae atque. Doloremque nobis repellat autem porro.

Socials

tiktok:

- url : https://tiktok.com/@lmitchell

- username : lmitchell

- bio : Eius velit possimus voluptas nostrum.

- followers : 566

- following : 196

facebook:

- url : https://facebook.com/lambert_dev

- username : lambert_dev

- bio : Et et est et et eius. Nulla culpa distinctio minima deserunt consequatur.

- followers : 5017

- following : 1237

instagram:

- url : https://instagram.com/lambert6270

- username : lambert6270

- bio : Veritatis aut dolorum officia sunt odit. Ducimus rem quo ea aut quod iusto vel.

- followers : 5214

- following : 1184