In an increasingly cashless world, digital payment apps have become indispensable tools for managing our daily finances. Among them, Venmo stands out, often lauded for its ease of use and social features. It’s the go-to app for splitting dinner bills, sharing rent, or even sending a quick cash gift. Yet, despite its widespread adoption and apparent convenience, a growing chorus of users is starting to voice a different sentiment: "Venmo sucks." This isn't just a casual complaint; it reflects deeper issues that can impact your financial security and peace of mind.

The appeal is undeniable. Venmo makes settling up with friends feel more like a casual chat than a financial transaction. You can send and receive money with Venmo friends to split everyday necessities, bills, and shared activities like takeout or travel. The platform boasts features that let you pick the perfect gift and wrap it up in the app, or send a personalized card that’s linked to a cash gift—all with Venmo. It promises to be more than just a way to pay; it lets you split bills, keep track of expenses, send gifts, and even express yourself with custom payment notes and emojis. But beneath this glossy veneer of convenience and social interaction, significant problems lurk, making many question if the benefits truly outweigh the risks.

Table of Contents

- The Allure of Convenience: What Venmo Promises

- When "Venmo Sucks": Unpacking the Core Frustrations

- Security Scares and Fraudulent Fortunes: Why Your Money Isn't Always Safe

- Customer Service Conundrums: A Black Hole of Support

- Privacy Predicaments: More Than Just "Venmo Friends"

- Hidden Fees and Unexpected Holds: The Financial Fine Print

- Alternatives to Venmo: Better Ways to Pay and Get Paid

- Navigating the Digital Payment Landscape: Tips for Users

The Allure of Convenience: What Venmo Promises

At its core, Venmo is a digital wallet that lets you make and share payments with friends. The process is remarkably straightforward: enter email, mobile, or username, and you're ready to go. Download the iOS or Android app or sign up on venmo.com, and you can easily split the bill, cab fare, or much more. This simplicity is a major draw, especially for younger generations accustomed to instant digital interactions. Venmo allows you to pay and request money from your friends, providing a social way to pay your friends when you owe them money and don't want to carry cash.

The platform positions itself as a seamless solution for everyday financial interactions. Whether you’re splitting everyday bills, paying your friend back for an activity, or sending a gift card, Venmo makes it happen with minimal fuss. Millions of people use Venmo to pay, get paid, shop, and share, a testament to its perceived utility.

Seamless Transactions: Splitting Bills and More

One of Venmo's strongest selling points is its ability to simplify group payments. Imagine a dinner out with friends: instead of fumbling for cash or trying to calculate who owes what, one person pays the bill, and everyone else can instantly send their share via Venmo. This functionality extends to rent, utilities, and even shared vacation expenses. The Venmo app makes settling up with friends feel more intuitive and less awkward. The promise is that when you send (or receive) a payment on Venmo, the payment should reach the recipient's Venmo account right away. This immediacy is a huge factor in its popularity, as it eliminates waiting periods associated with traditional bank transfers.

The Social Aspect: Payments with a Personal Touch

Unlike traditional banking apps, Venmo injects a social element into financial transactions. You can express yourself with custom payment notes and emojis, turning a mundane payment into a playful interaction. This feature, combined with the public or friends-only feed of transactions, creates a unique social network around money. It’s not just about moving funds; it’s about sharing experiences. The ability to send a personalized card linked to a cash gift, all within the app, further blurs the line between a financial tool and a social platform. This blend of utility and social engagement is precisely what attracts so many users, making it feel less like a chore and more like a connected experience.

When "Venmo Sucks": Unpacking the Core Frustrations

Despite the appealing features and widespread adoption, a significant number of users find themselves asking, "Why does Venmo suck so much?" The frustrations often stem from issues that are either downplayed by the company or only become apparent when something goes wrong. These aren't minor glitches; they can involve significant financial stress, privacy breaches, and a profound sense of helplessness. The very features that make Venmo convenient can, paradoxically, become its biggest liabilities when misused or when the system falters. From security vulnerabilities to frustrating customer support experiences, the cracks in Venmo's seemingly seamless facade are becoming increasingly visible to those who rely on it for their daily transactions.

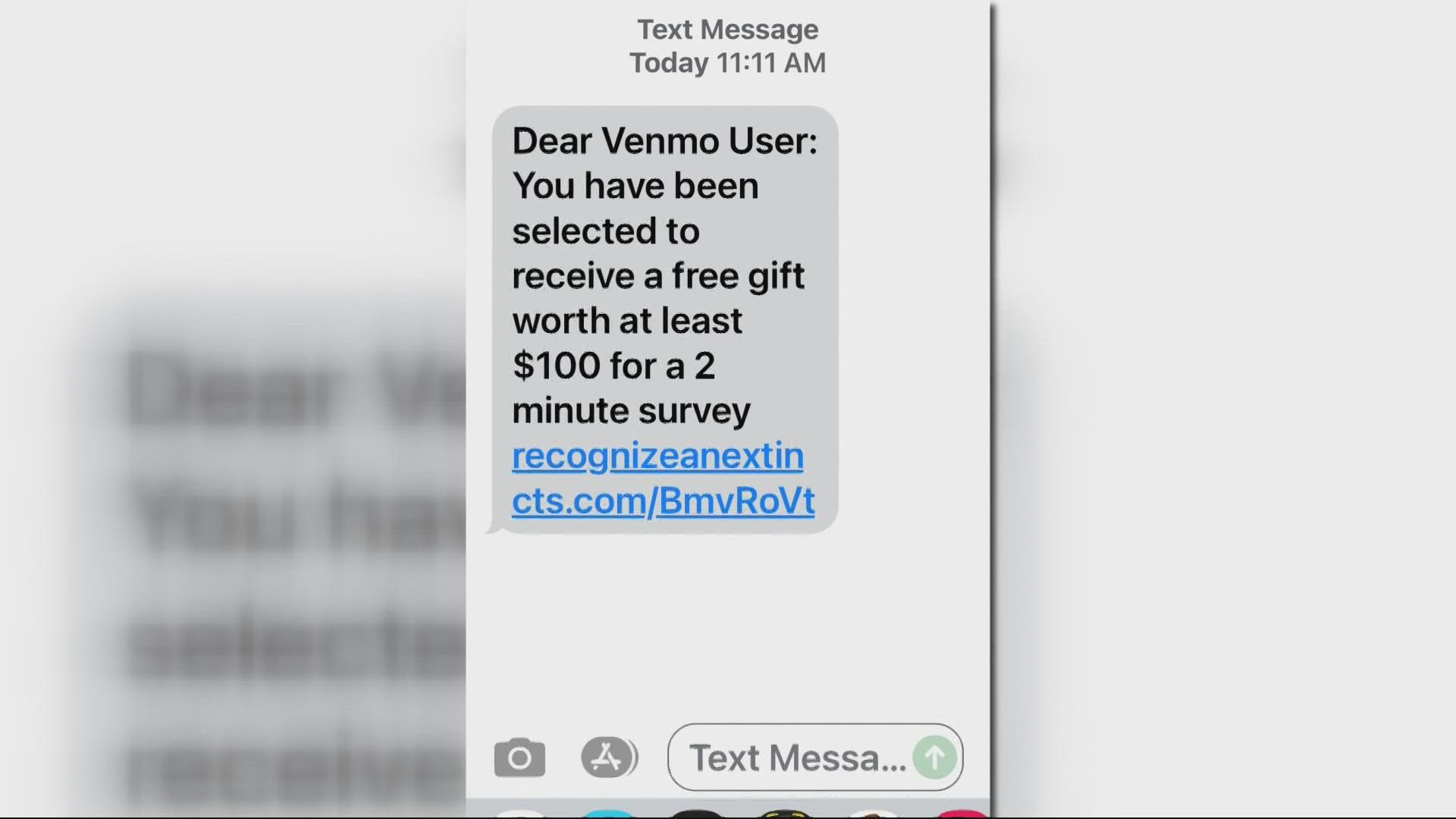

Security Scares and Fraudulent Fortunes: Why Your Money Isn't Always Safe

While Venmo states that "when you send (or receive) a payment on Venmo, the payment should reach the recipient's Venmo account right away," this immediacy can be a double-edged sword. If that payment is sent to the wrong person, or worse, if your account is compromised, recovering your funds can be an uphill battle, often leading to the sentiment that Venmo sucks. The platform, like any digital service, is a target for scammers and hackers, and its unique features sometimes inadvertently aid these malicious actors.

The Perils of Public Payments

One of Venmo's most distinctive features—the public transaction feed—is also one of its most controversial security risks. By default, many transactions are public, meaning anyone can see who paid whom, and for what, even if the specific amount is hidden. While you can adjust these settings to "friends only" or "private," many users are unaware of this default or simply forget to change it. This public exposure can reveal sensitive personal information, spending habits, and even location data, making users vulnerable to targeted scams, identity theft, or even physical threats. Cybersecurity experts have repeatedly warned about the dangers of sharing such intimate financial details with the world, turning a social feature into a potential security nightmare. This lack of inherent privacy protection contributes heavily to the feeling that Venmo sucks for those who value their digital anonymity.

Account Freezes and Funds in Limbo

A common and deeply frustrating complaint among users is the sudden and often unexplained freezing of accounts. This can happen for a variety of reasons, from suspected fraudulent activity (sometimes erroneously flagged) to large transactions that trigger automated security protocols. When an account is frozen, users lose access to their funds, which can be catastrophic if those funds are needed for immediate expenses. The process of unfreezing an account is often protracted, involving submitting numerous documents and waiting for Venmo's internal review process. During this time, your money is in limbo, inaccessible, and the lack of clear communication or a direct line to a resolution specialist only exacerbates the problem. For small businesses or individuals relying on Venmo for quick payments, an unexpected freeze can cripple their operations and lead to significant financial distress, reinforcing the idea that Venmo sucks when you need it most.

Customer Service Conundrums: A Black Hole of Support

Perhaps one of the most consistent and infuriating reasons why users declare "Venmo sucks" is the notoriously poor customer service. When you encounter an issue – a fraudulent charge, a frozen account, a payment sent to the wrong person, or a technical glitch – getting timely and effective help from Venmo can feel like shouting into a void.

Users frequently report long wait times for email responses, unhelpful automated replies, and a general inability to speak directly with a human representative who can actually resolve complex issues. While Venmo offers a section to "Find answers to commonly asked questions relating to your personal or business account," these FAQs often fall short when dealing with unique or critical problems. The lack of a robust, accessible customer support system means that when your money is on the line, you're often left to navigate a labyrinth of online forms and generic responses, leaving users feeling abandoned and frustrated. This deficiency is a significant departure from traditional banking services, where direct human assistance is typically available for urgent financial matters. The impersonal nature of Venmo's support system is a major contributor to user dissatisfaction, especially when compared to the immediacy of its payment features.

Privacy Predicaments: More Than Just "Venmo Friends"

Venmo’s blend of financial transactions with social media features raises significant privacy concerns that extend beyond the public feed. While the app positions itself as a convenient way to "send and receive money with Venmo friends," the reality of data collection and usage can be far more intrusive.

Every transaction, every note, every emoji contributes to a vast dataset that Venmo (and its parent company, PayPal) collects about your spending habits, social connections, and lifestyle. While this data is often anonymized for analytical purposes, the sheer volume and granularity of information can be unsettling. Furthermore, default privacy settings, which often lean towards public or "friends-only" visibility, mean that unless users proactively adjust them, their financial lives are more exposed than they might realize. This includes details about who they pay, what they pay for, and how frequently. For many, the idea that their financial activities are not entirely private, even among "friends," is a major reason why they feel Venmo sucks for their personal data security. The ease of signing up for a personal Venmo account, where you just "Enter email, mobile, or username," doesn't always come with an immediate, clear understanding of the privacy implications involved in sharing payments socially.

Hidden Fees and Unexpected Holds: The Financial Fine Print

While Venmo is often marketed as a "free" way to send and receive money, this isn't entirely true, and the unexpected costs can be a source of significant frustration, leading many to conclude that Venmo sucks. The core functionality of sending money from a linked bank account or Venmo balance to another Venmo user is indeed free. However, the moment you want to access your money quickly, or use certain payment methods, fees come into play.

- Instant Transfers: If you need to transfer money from your Venmo balance to your bank account instantly, Venmo charges a 1.75% fee (with a minimum fee of $0.25 and a maximum of $25). While standard transfers are free, they can take 1-3 business days, which defeats the purpose of "instant" digital payments for many users.

- Credit Card Payments: If you pay with a credit card, Venmo charges a 3% fee. This fee is standard across many payment processors, but it can be an unpleasant surprise for users who aren't aware of it.

- Commercial Transactions: While Venmo is primarily for peer-to-peer payments, some businesses use it. If you're paying a business for goods or services, Venmo charges the business a fee (typically 1.9% + $0.10 per transaction). While this doesn't directly affect the consumer, it means some businesses might pass on these costs or prefer other payment methods.

- Holds on Funds: Similar to account freezes, Venmo can place holds on received funds if they detect suspicious activity or if a payment is flagged for review. This can mean your money is inaccessible for days or even weeks, causing significant inconvenience and financial strain, especially for those who rely on immediate access to funds.

These fees and potential holds, often not immediately apparent to casual users, chip away at the perceived "free" nature of the service. When a user realizes they have to pay to access their own money quickly, or that a payment source incurs an unexpected charge, it quickly contributes to the sentiment that Venmo sucks. The fine print, while technically available, is often overlooked until it impacts a user's wallet directly.

Alternatives to Venmo: Better Ways to Pay and Get Paid

Given the frustrations that lead many to believe Venmo sucks, it's worth exploring other digital payment options that might better suit your needs, especially concerning security, customer service, and fee structures. While no platform is perfect, some alternatives offer different strengths that might alleviate the common pain points associated with Venmo.

- Zelle: Directly integrated with many major banks, Zelle offers a seamless way to send money directly from your bank account to another person's bank account, typically within minutes. There are generally no fees for sending or receiving money, and since it operates within the banking system, it often comes with the inherent security and customer support of your own bank. The main drawback is its lack of social features, but for pure money transfer, it's highly efficient.

- PayPal: As Venmo's parent company, PayPal offers a more robust and globally recognized platform. It has stronger buyer and seller protection policies, making it a safer choice for transactions with strangers or for online purchases. While it can have more complex fee structures for certain transactions (especially international ones), its customer service is generally considered more accessible and effective than Venmo's for dispute resolution.

- Cash App: Popular for its simplicity and direct deposit features, Cash App allows users to send and receive money, invest in stocks and Bitcoin, and even has its own debit card. It offers instant transfers for a small fee, similar to Venmo, but its interface and features cater to a slightly different user base.

- Google Pay/Apple Pay: These mobile wallet services allow you to link your debit or credit cards and make payments in stores or online. While they are primarily for point-of-sale transactions, they also offer peer-to-peer payment features, often with strong security protocols backed by tech giants.

- Traditional Bank Transfers: For larger sums or less urgent transfers, direct bank transfers (ACH) remain a highly secure and often free option. While slower, they offer the peace of mind of dealing directly with your financial institution.

Each of these alternatives has its own set of pros and cons, but exploring them can help you find a digital payment solution that aligns better with your priorities, whether that's privacy, customer support, or avoiding hidden fees.

Navigating the Digital Payment Landscape: Tips for Users

Regardless of whether you stick with Venmo or switch to an alternative, being an informed and cautious user is paramount in the digital payment landscape. Your money and personal data are at stake, making it crucial to adopt best practices to protect yourself from the issues that make many users feel "Venmo sucks."

- Verify Recipients Carefully: Always double-check the username, email, or phone number of the recipient before sending money. Payments on Venmo are often instant and irreversible. As Venmo states, "When you send (or receive) a payment on Venmo, the payment should reach the recipient's Venmo account right away," meaning there's little room for error.

- Understand Privacy Settings: If you use Venmo, immediately go into your settings and change your default transaction privacy to "Private." This prevents your financial activities from being visible to strangers or even your "Venmo friends" if you prefer.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security to your account, requiring a code from your phone in addition to your password when logging in from a new device.

- Use Strong, Unique Passwords: Never reuse passwords across different online services. A strong, complex password significantly reduces the risk of your account being compromised.

- Be Wary of Scams: Be highly suspicious of payment requests from unknown individuals or offers that seem too good to be true. Never send money to someone you don't know, especially if they claim to have accidentally sent you too much and are asking for a refund.

- Link a Debit Card or Bank Account: While credit cards offer some consumer protection, using them on Venmo incurs a 3% fee. Linking a debit card or bank account avoids this fee for most transactions. Remember, "If you're paying with a bank account, it..." is typically free for standard transfers.

- Monitor Your Accounts: Regularly check your Venmo transaction history and linked bank or credit card statements for any unauthorized activity.

- Keep the App Updated: Ensure you "Download the iOS or Android app or sign up on venmo.com today" and keep your app updated to the latest version. Updates often include security patches and bug fixes.

- Read the Fine Print: Before signing up for a personal Venmo account, make sure you meet all the requirements for signing up for Venmo and understand "How payments work on Venmo," including potential fees for instant transfers or credit card use.

By taking these proactive steps, you can significantly mitigate the risks associated with digital payment apps and ensure that your experience is as smooth and secure as possible, avoiding the pitfalls that lead many to conclude that Venmo sucks.

Conclusion

Venmo has undeniably revolutionized how we "send and receive money with Venmo friends to split everyday necessities, bills, and shared activities like takeout or travel." Its social features, ease of use, and instant payment capabilities have made it a staple for millions. However, the pervasive sentiment that "Venmo sucks" is not without merit. From the frustrating lack of accessible customer service and the opaque processes for resolving account freezes, to significant privacy concerns stemming from its social feed and the hidden fees for instant transfers, the platform presents a range of challenges that can turn convenience into a headache.

While Venmo claims to be "more than just a way to pay," allowing you to "split bills, keep track of expenses, send gifts, and more," users must weigh these benefits against the potential risks to their financial security and privacy. Being informed about the platform's limitations and proactively managing your settings and transactions are crucial. Ultimately, whether Venmo is the right choice for you depends on your priorities and risk tolerance. We encourage you to share your own experiences with Venmo in the comments below – what has worked well for you, and what has made you feel that Venmo sucks? Your insights can help others make informed decisions in the evolving world of digital payments. For more tips on managing your digital finances securely, explore our other articles on online banking safety and choosing the right payment apps.

Detail Author:

- Name : Mrs. Darby Rolfson DDS

- Username : bmiller

- Email : kemmer.tillman@hotmail.com

- Birthdate : 2006-07-02

- Address : 212 Kristoffer Stream Dickensfurt, WV 73648-9837

- Phone : +1-906-313-6395

- Company : Zulauf PLC

- Job : Fence Erector

- Bio : Sunt rerum maxime quia ut velit aut. Nam iusto beatae omnis iure ab voluptas. Est beatae voluptate consequatur voluptatem ut neque aut. Eum fuga sit reprehenderit voluptas quae quo voluptas.

Socials

facebook:

- url : https://facebook.com/drenner

- username : drenner

- bio : Assumenda praesentium eius dicta est et quis perferendis.

- followers : 2567

- following : 1034

twitter:

- url : https://twitter.com/drenner

- username : drenner

- bio : Vel deleniti porro qui odit sit doloremque eveniet. Similique totam sequi dolores eum. Enim voluptatem officiis quae rerum autem quibusdam.

- followers : 1768

- following : 986

linkedin:

- url : https://linkedin.com/in/dallas_official

- username : dallas_official

- bio : Aut doloribus qui similique aut.

- followers : 1710

- following : 1897

tiktok:

- url : https://tiktok.com/@dallas.renner

- username : dallas.renner

- bio : Esse dolorem dolore nihil excepturi cupiditate quia id.

- followers : 180

- following : 2221

instagram:

- url : https://instagram.com/drenner

- username : drenner

- bio : Nemo sunt asperiores autem. Quia ea ut neque. Et sit optio repellendus delectus.

- followers : 6500

- following : 957