In the dynamic world of stock market investing, staying informed and connected is paramount. For those tracking specific companies, platforms like Stocktwits have become invaluable hubs for real-time discussions, sentiment analysis, and community insights. Among the myriad of tickers discussed, DHAI, representing DIH Holdings US Inc., frequently emerges as a focal point, drawing attention from both seasoned investors and curious newcomers. Understanding the interplay between DHAI's market performance and its community discussions on Stocktwits offers a unique lens into investor psychology and potential market movements.

DIH Holdings US Inc. operates in a fascinating and increasingly relevant sector: robotics and virtual reality (VR) technology for the rehabilitation industry. This focus on improving the lives of millions with disabilities gives the company a compelling narrative, but like any investment, it comes with its own set of complexities and market dynamics. Exploring DHAI through the lens of Stocktwits allows us to not only examine its financial standing but also to gauge the collective mood and speculative energy surrounding it.

Table of Contents

- Understanding DHAI: DIH Holdings US Inc.

- DHAI on the NASDAQ: A Market Overview

- The Power of Stocktwits for Investors

- Navigating DHAI Discussions on Stocktwits

- Key Metrics and Fundamentals for DHAI Analysis

- Short Interest and Market Dynamics in DHAI

- Advanced Charting and Technical Analysis for DHAI

- Beyond DHAI: Related Discussions and Industry Insights

- Making Informed Decisions in the World of DHAI Stocktwits

Understanding DHAI: DIH Holdings US Inc.

DIH Holdings US Inc., trading under the ticker DHAI on the NASDAQ GM, is not just another company; it's a mission-driven entity focused on "deliver inspiration & health" to improve the functioning of millions of people with disability. Its core business revolves around providing robotics and virtual reality (VR) technology solutions specifically tailored for the rehabilitation industry across Europe, the Middle East, Africa, and the United States. This niche but critical sector addresses a growing global need for advanced therapeutic tools.

The company's offerings likely include robotic exoskeletons for gait training, VR systems for cognitive rehabilitation, and other innovative devices designed to enhance patient recovery and quality of life. As healthcare evolves, the integration of cutting-edge technology like robotics and VR in rehabilitation is becoming increasingly vital, positioning DHAI within a sector with significant long-term potential. Understanding DHAI's operational scope and its commitment to innovation is the first step in assessing its investment viability.

DHAI on the NASDAQ: A Market Overview

As a publicly traded company on the NASDAQ Global Market (NASDAQ GM), DHAI is subject to the scrutiny and dynamics of the broader stock market. Its listing on a major exchange like NASDAQ provides visibility and liquidity, allowing investors to buy and sell shares. For potential investors, monitoring DHAI's stock price, historical data, and analyst ratings is crucial. Financial news outlets like the Wall Street Journal (WSJ) and Perplexity provide detailed financial information, including stock price trends, earnings reports, and any stock split history, which can significantly impact share value and investor perception.

The NASDAQ GM segment typically lists companies that meet specific financial and liquidity requirements, suggesting a certain level of maturity and stability compared to smaller, less regulated exchanges. However, even within the NASDAQ, companies like DHAI can experience significant price dynamics based on company news, sector trends, and overall market sentiment. This is where platforms like Stocktwits become particularly relevant, offering a real-time pulse of how the investment community is reacting to these factors.

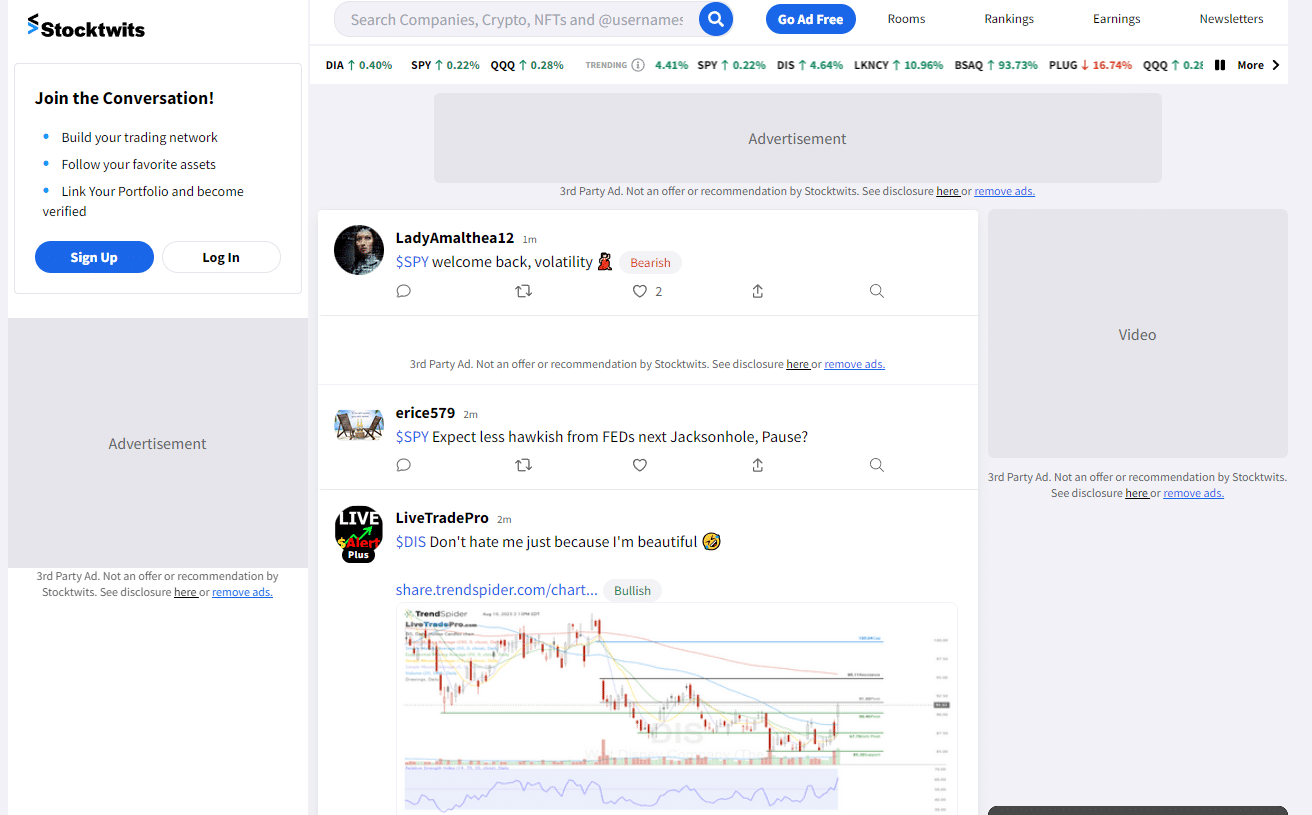

The Power of Stocktwits for Investors

Stocktwits has carved out a unique niche as a social media platform specifically for investors and traders. It's often described as a Twitter for stocks, allowing users to share ideas, insights, and real-time reactions to market events. For a stock like DHAI, Stocktwits serves multiple critical functions:

- Real-time Information Flow: Users can post messages (often called "tweets" or "cashtags" when referring to a stock like #DHAI), charts, and news links, providing an immediate snapshot of what the community is discussing.

- Sentiment Gauging: The platform allows users to tag their posts as "bullish" or "bearish," offering a quick visual representation of the prevailing sentiment towards a stock. This collective sentiment can sometimes act as a leading or lagging indicator of price movements.

- Community Insights: Investors can discover new trade ideas, gain insights from experienced traders, and engage in discussions that might uncover perspectives not found in traditional financial news.

- News Aggregation: While not a primary news source, Stocktwits often acts as a rapid aggregator, with users sharing breaking news, press releases, or analyst upgrades/downgrades as soon as they emerge.

- Direct Communication: Companies, or their investor relations teams, can sometimes engage directly with the community, providing updates or clarifying information, though this is less common for smaller caps.

However, it's crucial to approach Stocktwits with a critical eye. While it offers valuable insights, it's also prone to speculation, misinformation, and emotional trading. As such, it should be used as one tool among many in a comprehensive investment strategy, not as the sole basis for decision-making.

Navigating DHAI Discussions on Stocktwits

For DHAI investors, the Stocktwits feed for the ticker #DHAI is a vibrant, often chaotic, but potentially insightful place. Messages range from simple price observations to detailed technical analysis, fundamental breakdowns, and even highly speculative predictions. Understanding how to navigate this stream of information is key to extracting value.

Deciphering Community Sentiment

The sentiment tags (bullish/bearish) provide a quick overview, but deeper analysis requires reading the actual posts. Look for recurring themes: Are people discussing new product launches? Regulatory approvals? Earnings reports? Or is the conversation dominated by short squeeze hopes or pump-and-dump warnings? A sudden shift from predominantly bullish to bearish sentiment, or vice versa, can sometimes precede price movements, though correlation does not imply causation.

It's also important to identify key contributors. Some users develop a reputation for informed analysis, while others are known for hype or FUD (Fear, Uncertainty, Doubt). Learning to distinguish between credible insights and mere noise is an acquired skill on platforms like Stocktwits.

Identifying Key Trends and Discussions

When tracking DHAI on Stocktwits, pay attention to the specific keywords and hashtags being used alongside #DHAI, such as #DHAISTOCKNEWS, #DHAISTOCKPREDICTION, or #DHAISTOCKFORECAST. These variations indicate the specific focus of the community's attention at any given moment. For instance, a surge in posts about #DHAISTOCKLATESTNEWS might signal an impending announcement or a reaction to recent company developments. Similarly, discussions around #DHAISTOCKANALYSIS often involve more in-depth technical or fundamental viewpoints.

The platform's search functionality allows users to delve into past discussions, providing historical context for current trends. This can be particularly useful for understanding how the community reacted to previous earnings calls, product announcements, or market-wide downturns, offering a glimpse into the stock's typical volatility and investor resilience.

Key Metrics and Fundamentals for DHAI Analysis

While Stocktwits offers a social perspective, any serious investment in DHAI must be grounded in fundamental and technical analysis. Financial platforms like Yahoo Finance, WSJ, and Perplexity provide critical data points for DIH Holding US Inc. (DHAI:NASDAQ GM):

- Stock Price and Chart: View more price dynamics on DHAI chart. This is the most basic, yet crucial, data point. Historical charts can reveal long-term trends, support/resistance levels, and volatility.

- Company News: Staying updated on company news is vital. This includes press releases about product developments, partnerships, financial results, or strategic initiatives.

- Key Statistics: These include market capitalization, outstanding shares, average daily volume, and other metrics that provide a snapshot of the company's size and liquidity.

- Fundamentals and Company Profile: Delve into the company's business model, management team, competitive landscape, and financial statements (revenue, profit, debt, cash flow). For DHAI, understanding its specific offerings in robotics and VR for rehabilitation is key to assessing its growth potential.

- Analyst Ratings and Forecasts: While not always available for smaller companies, analyst ratings can offer a professional perspective on the stock's future performance and target prices.

- Earnings Reports: These quarterly and annual reports provide a detailed look at the company's financial health and operational performance.

Combining these objective data points with the subjective sentiment from DHAI Stocktwits discussions can provide a more holistic view for making informed investment decisions. Remember, fundamentals drive long-term value, while sentiment can influence short-term price fluctuations.

Short Interest and Market Dynamics in DHAI

One specific piece of data mentioned in the provided text is: "As of October 15th, there was short." This refers to short interest, which is the total number of shares of a company's stock that have been sold short by investors but not yet covered (bought back to close the short position). High short interest can indicate that a significant number of investors believe the stock's price will decline. However, it can also set the stage for a "short squeeze" if the stock price unexpectedly rises, forcing short sellers to buy back shares to limit losses, thereby pushing the price even higher.

For DHAI, understanding the level of short interest is crucial for several reasons:

- Bearish Sentiment Indicator: A high and increasing short interest suggests that institutional investors or sophisticated traders are betting against the company.

- Potential for Volatility: Stocks with high short interest can be highly volatile. A sudden positive catalyst could trigger a short squeeze, leading to rapid price appreciation. Conversely, continued negative news could exacerbate declines.

- Community Discussion Point: Short interest is a frequent topic on Stocktwits. Traders often track these numbers, looking for opportunities to either join the short sellers or bet against them in anticipation of a squeeze.

Monitoring this metric alongside the general sentiment on DHAI Stocktwits can provide valuable clues about the underlying market dynamics and potential for significant price movements.

Advanced Charting and Technical Analysis for DHAI

Beyond fundamental analysis, technical analysis plays a significant role for many traders, especially those active on platforms like Stocktwits. The ability to "Create advanced interactive price charts for DHAI, with a wide variety of chart types, technical indicators, overlays, and annotation tools" is essential for identifying patterns, trends, and potential entry/exit points.

Technical analysis tools often discussed in the DHAI Stocktwits community include:

- Chart Types: Candlestick, line, bar charts to visualize price movements over time.

- Technical Indicators: Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, Volume, etc. These indicators help identify momentum, overbought/oversold conditions, and potential reversals.

- Overlays: Price channels, Fibonacci retracements, and trendlines that can be drawn directly on the chart to identify support and resistance levels.

- Annotation Tools: Allowing traders to mark up charts with notes, arrows, and shapes to highlight specific patterns or observations.

Many Stocktwits users share their technical analysis charts for DHAI, offering diverse perspectives on its price action. While technical analysis can be a powerful tool, it's often more effective when combined with fundamental understanding and a clear awareness of market news and sentiment.

Beyond DHAI: Related Discussions and Industry Insights

The Stocktwits ecosystem isn't limited to a single ticker. Investors following DHAI might also find themselves tracking related companies or broader industry trends. The provided data mentions other tickers like Vocodia Holdings Corp (VHAI), BigBear.ai Holdings Inc (BBAI), Spectral AI, Inc (MDAI), and Lifeward Ltd (LFWD). While these companies operate in different niches (e.g., AI, other tech), their discussions on Stocktwits often highlight broader themes relevant to growth stocks, micro-cap investing, or specific technological advancements.

The Rehabilitation Technology Landscape

DHAI's focus on robotics and VR for rehabilitation places it within a growing and evolving healthcare technology sector. Discussions on Stocktwits, while centered on DHAI, might occasionally touch upon the broader trends in this industry:

- Technological Advancements: New breakthroughs in AI, haptics, and sensor technology that could impact future rehabilitation devices.

- Market Size and Growth: The increasing demand for rehabilitation services due to an aging population and rising prevalence of chronic conditions.

- Competitive Landscape: Other companies, both public and private, operating in similar spaces.

- Regulatory Environment: FDA approvals, reimbursement policies, and other regulatory factors that can affect the adoption of new medical technologies.

The Role of Investor Relations and News

For any publicly traded company, effective investor relations (IR) is paramount. The data mentions "DIH holding us news & stocktwits investor relations." This highlights the importance of the company's communication with the investment community. Official news releases, investor presentations, and earnings calls are primary sources of information that should be cross-referenced with discussions on DHAI Stocktwits. While Stocktwits provides a platform for rapid dissemination and reaction, the official IR channels offer verified, comprehensive data. A well-managed IR strategy can build trust and transparency, which is particularly vital for smaller companies seeking to attract and retain investors.

Making Informed Decisions in the World of DHAI Stocktwits

Investing in stocks like DHAI, especially those discussed actively on social platforms, requires a balanced approach. While DHAI Stocktwits can be an excellent source of real-time sentiment and diverse perspectives, it is crucial to remember that it is not a substitute for rigorous personal due diligence. The "Your Money or Your Life" (YMYL) principle applies strongly here; investment decisions directly impact financial well-being, necessitating careful consideration and expert knowledge where possible.

To navigate this landscape effectively, consider the following:

- Verify Information: Always cross-reference claims made on Stocktwits with official company releases, reputable financial news outlets, and regulatory filings.

- Understand the Business: Deeply research DIH Holdings US Inc.'s business model, products, market position, and financial health. How does their robotics and VR technology truly "deliver inspiration & health"?

- Assess Risk: Companies in the technology and healthcare sectors, especially smaller ones, can be volatile. Understand the specific risks associated with DHAI, including market competition, technological obsolescence, and regulatory hurdles.

- Form Your Own Opinion: Use Stocktwits as a source of ideas and sentiment, but develop your own investment thesis based on your research and risk tolerance.

- Consider Diversification: Avoid putting all your capital into a single stock, regardless of how compelling the Stocktwits narrative might be.

In conclusion, the intersection of DHAI and Stocktwits represents a microcosm of modern investing: a blend of fundamental data, technical analysis, and powerful, often emotional, community sentiment. By understanding how to leverage the insights from DHAI Stocktwits while adhering to sound investment principles, investors can better navigate the opportunities and challenges presented by this intriguing company. The journey of investing is continuous learning; keep researching, keep questioning, and keep refining your strategy.

What are your thoughts on DHAI's future? Share your insights and join the conversation in the comments below, or explore other related articles on our site to deepen your market understanding!

Detail Author:

- Name : Prof. Willard Wuckert III

- Username : alvera45

- Email : ahmad46@macejkovic.com

- Birthdate : 1997-04-06

- Address : 5563 Hodkiewicz Crossing Gorczanystad, WI 24208-5497

- Phone : 1-586-534-4440

- Company : Heathcote-Grady

- Job : Curator

- Bio : Itaque unde sit repudiandae tenetur. Consequatur tempore perferendis vitae non sit quidem rem. Distinctio ut quis fugit odit animi vero. Voluptas est quasi in omnis quibusdam.

Socials

tiktok:

- url : https://tiktok.com/@edgardo_real

- username : edgardo_real

- bio : Voluptates atque mollitia architecto.

- followers : 230

- following : 1818

facebook:

- url : https://facebook.com/edgardo5747

- username : edgardo5747

- bio : Qui rerum tenetur in nisi modi aut expedita.

- followers : 5225

- following : 1463

instagram:

- url : https://instagram.com/edgardo_o'connell

- username : edgardo_o'connell

- bio : Debitis cumque dolore non. Ducimus atque reiciendis qui corporis. Suscipit voluptate ipsum dolorem.

- followers : 6157

- following : 2066

linkedin:

- url : https://linkedin.com/in/edgardoo'connell

- username : edgardoo'connell

- bio : Ullam officia et blanditiis recusandae.

- followers : 1040

- following : 510