Discovering an unfamiliar charge on your credit card statement can be a truly unsettling experience. In an era where digital transactions are commonplace, phrases like "Chat Versailles credit card charge" can appear out of nowhere, leaving you bewildered and concerned about potential fraud or an accidental subscription. This guide is designed to demystify such perplexing entries, providing you with clear, actionable steps to identify, understand, and resolve any suspicious activity on your financial records.

Understanding the nature of these charges is the first step towards regaining control of your financial peace of mind. Whether it's a legitimate, albeit forgotten, subscription, a merchant using an obscure billing name, or indeed, a fraudulent transaction, knowing how to investigate and what resources are available to you is crucial. Let's delve into how you can effectively tackle an unexpected "Chat Versailles" charge and safeguard your financial well-being.

Table of Contents

- What Exactly is a "Chat Versailles Credit Card Charge"?

- Why Do Mysterious Credit Card Charges Appear?

- Immediate Steps When You Spot an Unknown Charge

- Investigating the 'Chat Versailles' Charge: A Deep Dive

- When to Dispute a Charge: Fraud vs. Legitimate Dispute

- The Chargeback Process Explained

- Protecting Yourself from Future Unknown Charges

- The YMYL Aspect: Safeguarding Your Financial Health

What Exactly is a "Chat Versailles Credit Card Charge"?

The term "Chat Versailles credit card charge" itself is quite specific, yet for many, it remains an enigma. Unlike common merchant names like "Amazon" or "Starbucks," a charge appearing as "Chat Versailles" might not immediately ring a bell. This ambiguity is precisely what causes alarm. In most cases, such a descriptor points to one of several possibilities:

- A Specific Online Service: "Chat Versailles" could be the billing name for an online chat platform, a gaming service, a subscription to a digital content provider, or even a dating site. Many online services, especially those offering premium features or memberships, bill under names that might not be identical to their public-facing brand. The "chat" component suggests an interactive online service, perhaps one related to communication, social networking, or even AI-driven assistance.

- A Third-Party Billing Processor: Sometimes, smaller companies or international merchants use third-party payment processors whose names appear on your statement instead of the actual service provider. "Versailles" could be part of such a processor's name or an identifier for a specific service they handle.

- A Misleading or Obscure Description: Some businesses use vague or truncated descriptions on credit card statements to save space or for internal coding. This can lead to confusion for the consumer.

- Fraudulent Activity: Unfortunately, an unknown charge is always a red flag for potential credit card fraud. This could be a result of your card details being compromised through a data breach, phishing scam, or physical theft.

Given the "chat" element, it's worth considering the vast landscape of online communication platforms. From free chat websites that let you connect with people quickly and easily, featuring mobile chat rooms as well, to more structured platforms like ChatGPT, Google Chat, or Bing Chat, the digital world is replete with services that could potentially lead to a charge, especially if they offer premium tiers. While many general chat services like Chatib.us (which boasts no download, no setup & no registration needed for meeting new friends) or Chatogo (an international chat where you can chat without strict limits or sign-up) are free, others might offer advanced features that come with a cost. The key is to determine if "Chat Versailles" is one such service you or someone in your household might have knowingly or unknowingly engaged with.

Why Do Mysterious Credit Card Charges Appear?

Beyond the specific "Chat Versailles credit card charge," understanding the broader reasons behind mysterious credit card entries can help you approach the problem systematically. These charges are a common source of consumer anxiety, and they typically stem from a few core issues:

- Forgotten Subscriptions or Free Trials: This is perhaps the most common culprit. Many online services offer free trials that automatically convert to paid subscriptions if not cancelled before the trial period ends. You might have signed up for a service months ago and simply forgotten about it. This could easily apply to an online "chat" service that offered a trial.

- Family Member Purchases: If you share your credit card with a spouse, child, or another family member, they might have made a purchase that you're unaware of, or they might have signed up for a service like a premium chat or gaming platform.

- Merchant Name Variations: Businesses often register under one legal name but operate under a different "doing business as" (DBA) name. The name appearing on your statement might be the legal entity's name or a parent company's name, which can differ significantly from the brand you recognize.

- Billing Errors: Mistakes happen. A merchant might accidentally double-charge you, or there could be a clerical error that leads to an incorrect charge.

- Unauthorized Use/Fraud: This is the most serious concern. Your credit card details could have been stolen and used for unauthorized purchases. This can happen through various means, including data breaches, skimming devices, or phishing scams.

- Pre-authorizations or Holds: Sometimes, a temporary hold is placed on your card for things like hotel reservations, car rentals, or even online service trials. These are not actual charges but can appear as pending transactions. While usually reversed, they can cause confusion.

Immediate Steps When You Spot an Unknown Charge

When you first notice an unfamiliar entry like a "Chat Versailles credit card charge" on your statement, don't panic. Act quickly and methodically. Your immediate actions can significantly impact how easily and effectively you resolve the issue.

- Don't Immediately Assume Fraud: While fraud is a possibility, jumping to conclusions can cause unnecessary stress. First, consider if it might be a legitimate charge you've forgotten or a merchant name you don't recognize.

- Check Recent Purchases: Review your own recent online and offline purchases. Did you sign up for any new services or trials around the date of the charge? Did you make a purchase from a less common vendor?

- Consult Family Members: If others have access to your card or account, ask them if they recognize the charge. This often resolves the mystery quickly, especially with charges related to online entertainment or communication.

- Review Your Email and SMS: Search your email inbox and text messages for keywords like "Versailles," "chat," "subscription," or the exact amount of the charge. Confirmation emails, receipts, or trial sign-up notifications often provide the missing link.

- Log into Your Online Banking/Credit Card Account: Online statements often provide more detailed information about a transaction than a paper statement, sometimes including a merchant's website or contact number. Look for any additional details associated with the "Chat Versailles credit card charge."

Investigating the 'Chat Versailles' Charge: A Deep Dive

Once you've taken the initial steps, it's time to dig deeper into the "Chat Versailles credit card charge." This investigative phase is critical for determining if the charge is legitimate, an error, or outright fraud.

Checking Your Own Activity and Digital Footprint

Consider your online habits. Have you recently explored new online chat rooms, perhaps free chat websites that let you connect with people quickly and easily, or more advanced AI tools? Services like ChatGPT help you get answers, find inspiration, and be more productive, and while it is free to use and easy to try, premium versions or associated services might incur charges. Similarly, Google Chat and Bing Chat offer powerful collaboration and AI features. While the core services are often free, integrations or premium features could lead to charges. Think about:

- New Apps or Software: Did you download any new applications or software that might have a subscription component?

- Online Gaming or Entertainment: Many games or streaming services offer in-app purchases or premium memberships.

- Dating or Social Networking Sites: Premium features on these platforms often come with recurring charges.

- Trial Periods: Revisit any free trials you might have signed up for in the past few months. Many automatically convert to paid subscriptions.

Even seemingly innocuous interactions, like exploring how Google Chat helps individuals, groups, and businesses to connect and collaborate online, or learning how you can access Bing Chat in Microsoft Edge to experience AI and ask complex questions, could potentially lead to an offer for a paid service. It's easy to forget these fleeting explorations, but they can sometimes manifest as a recurring charge.

Contacting the Merchant or Service Provider

If your initial checks don't yield answers, try to identify and contact the merchant behind the "Chat Versailles credit card charge."

- Google the Charge Description: Type "Chat Versailles credit card charge" into a search engine. Often, others have experienced the same mysterious charge and have shared their findings on consumer forums or review sites. This can quickly reveal the actual company name or service.

- Search for the Charge Amount: Sometimes, searching for the exact charge amount along with the date can also help identify the merchant, especially if it's a recurring charge.

- Look for Contact Information: Once you have a potential merchant name, search for their official website and customer service contact details. Be wary of unofficial sites.

- Prepare Your Information: When you contact them, have your credit card statement, the date and amount of the charge, and any other relevant details ready. Explain that you do not recognize the "Chat Versailles credit card charge" and are seeking clarification.

Leveraging Online Resources and Community Forums

The internet is a powerful tool for consumer advocacy.

- Consumer Complaint Databases: Websites like the Better Business Bureau (BBB) or the Consumer Financial Protection Bureau (CFPB) allow consumers to file complaints and often have databases of businesses and their associated complaints.

- Fraud Reporting Sites: The Federal Trade Commission (FTC) has a dedicated portal for reporting fraud, which can be useful if you suspect the "Chat Versailles credit card charge" is indeed fraudulent.

- Online Forums and Social Media: Many online communities and social media groups are dedicated to discussing credit card issues and identifying unknown charges. A quick search might reveal that many others have encountered the exact "Chat Versailles credit card charge" and have already found a resolution. These platforms can offer insights and even direct contact information for obscure merchants.

When to Dispute a Charge: Fraud vs. Legitimate Dispute

Once you've conducted your investigation into the "Chat Versailles credit card charge," you'll likely fall into one of two categories:

- Legitimate (but forgotten/unrecognized) Charge: You've identified the merchant, and it turns out to be a service you or a family member signed up for. In this case, you might decide to keep the service, cancel it, or request a refund if it was an accidental sign-up or a billing error.

- Fraudulent or Unresolved Charge: You cannot identify the merchant, or you've confirmed that neither you nor anyone authorized to use your card made the purchase. This is when you need to dispute the charge with your credit card company.

It's crucial to understand the difference. A "legitimate dispute" might be for a service you received but were unsatisfied with, or a double charge. "Fraud" means the transaction was completely unauthorized. Credit card companies have different procedures for each. For a "Chat Versailles credit card charge" that remains a mystery after your thorough investigation, it's safer to lean towards reporting it as potentially fraudulent.

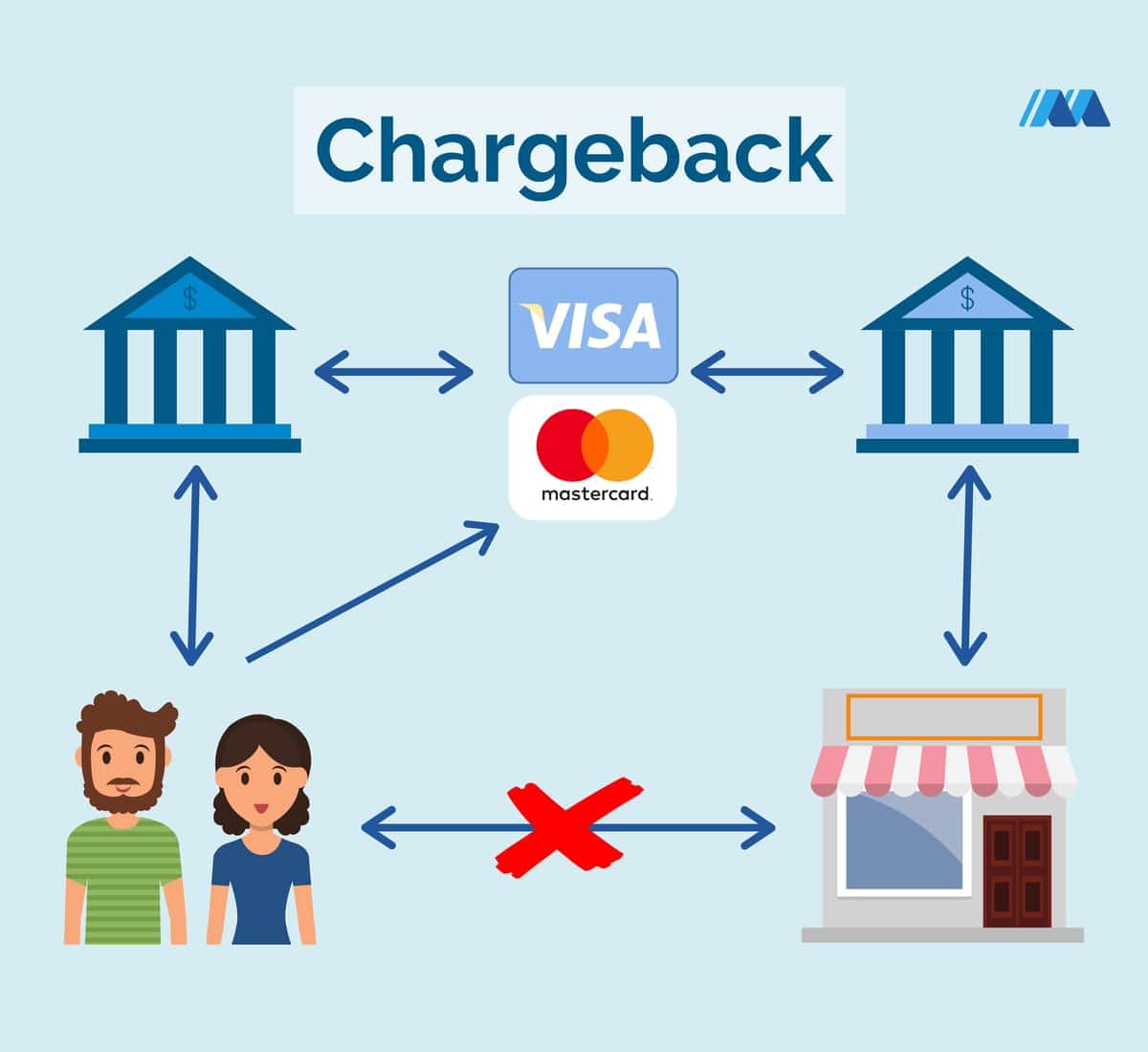

The Chargeback Process Explained

If you've determined that the "Chat Versailles credit card charge" is unauthorized or fraudulent, initiating a chargeback is your next step. A chargeback is a reversal of a payment made on a credit card, initiated by the cardholder's bank. Here’s how it generally works:

- Contact Your Credit Card Issuer: As soon as you suspect fraud or an unauthorized charge, call the customer service number on the back of your credit card. Explain that you see an unfamiliar "Chat Versailles credit card charge" and wish to dispute it.

- Provide Details: Be prepared to provide the date of the charge, the amount, the merchant name (as it appears on your statement), and a brief explanation of why you are disputing it. The more information you can provide from your investigation, the better.

- Fraud vs. Dispute: Clearly state if you believe it's fraud (unauthorized use) or a billing error/service dispute. For "Chat Versailles credit card charge" if you truly don't recognize it, report it as unauthorized.

- Temporary Credit: In many cases, your credit card company will issue a temporary credit to your account while they investigate the dispute. This means the amount of the charge will be removed from your balance, but it's not a final resolution.

- Investigation: Your credit card company will investigate the charge. They might contact the merchant for proof of purchase or service. This process can take several weeks, or even months, depending on the complexity of the case.

- Resolution: If the investigation concludes in your favor, the temporary credit becomes permanent, and the charge is removed from your statement. If it's found to be legitimate, the charge will be reinstated.

- New Card: If fraud is suspected, your credit card company will likely cancel your current card and issue you a new one with a different number to prevent further unauthorized transactions.

Remember, consumer protection laws, like the Fair Credit Billing Act (FCBA) in the U.S., provide significant rights to consumers regarding billing errors and unauthorized charges. You generally have 60 days from the date the statement containing the error was sent to dispute a charge. However, it's always best to act as quickly as possible.

Protecting Yourself from Future Unknown Charges

Dealing with a "Chat Versailles credit card charge" is a learning experience. Here are proactive steps you can take to minimize the risk of future mysterious charges:

- Monitor Your Statements Regularly: Don't wait for your monthly statement to arrive. Check your online credit card activity frequently, ideally once a week. Early detection is key.

- Set Up Transaction Alerts: Most credit card companies offer email or SMS alerts for transactions above a certain amount, or for all transactions. This can notify you immediately of any suspicious activity.

- Use Virtual Card Numbers: Some banks and payment services offer virtual card numbers for online purchases. These are temporary, single-use numbers linked to your actual card, adding an extra layer of security.

- Be Cautious with Free Trials: Always read the terms and conditions of free trials carefully, especially regarding automatic renewals. Set a reminder to cancel before the trial period ends if you don't intend to continue.

- Secure Your Devices: Ensure your computer and mobile devices are protected with strong antivirus software and firewalls. Regularly update your operating system and applications.

- Use Strong, Unique Passwords: For all online accounts, especially those linked to payment information, use complex, unique passwords. Consider a password manager.

- Be Wary of Phishing Scams: Never click on suspicious links in emails or text messages, and never provide your credit card details in response to unsolicited requests.

- Shred Old Documents: Properly dispose of old credit card statements, receipts, and other documents containing sensitive financial information.

The YMYL Aspect: Safeguarding Your Financial Health

The topic of "Chat Versailles credit card charge" falls squarely under the "Your Money or Your Life" (YMYL) category, emphasizing its critical importance to your financial well-being and overall security. Information regarding credit card charges, fraud prevention, and dispute resolution directly impacts a person's financial stability and peace of mind. Therefore, the advice provided must be accurate, authoritative, and trustworthy.

Maintaining vigilance over your financial accounts is not merely a recommendation; it's a fundamental aspect of modern financial literacy. Unknown charges, even small ones, can be indicators of larger security breaches. Ignoring them could lead to significant financial losses, identity theft, or a damaged credit score. Reputable financial institutions and consumer protection agencies consistently advise proactive monitoring and immediate action when discrepancies arise. By understanding the mechanisms behind charges like "Chat Versailles credit card charge" and knowing how to respond, you are actively participating in the safeguarding of your financial health. This expertise empowers you to navigate the complexities of digital transactions with confidence, ensuring your money remains where it belongs – securely in your control.

Navigating Digital Interactions and Charges

The prevalence of online chat services, from casual interactions on free chat websites that help you find and connect with single women and men throughout the globe, to professional collaboration tools, means that digital interactions are a constant in our lives. While many services are free, the line between free and paid can sometimes blur, especially with premium features or "freemium" models. This makes understanding your digital footprint and potential associated charges more important than ever.

For instance, while ChatGPT is free to use and easy to try, offering help with writing, learning, and brainstorming, its future iterations or specialized versions might come with a cost. Similarly, Google Chat and Bing Chat offer powerful features for personal and professional collaboration, but third-party integrations or advanced functionalities could involve subscriptions. Even anonymous text or video chats on platforms like Chatib.us or Chatogo, which boast no registration needed, might have premium tiers or ads that could inadvertently lead to clicks on services that then charge.

It's crucial to exercise caution when exploring new online services, especially those that request payment information for "free trials." Always ensure you understand what you are signing up for and how to cancel. This proactive approach can prevent future "Chat Versailles credit card charge" type mysteries.

Expert Advice: Consulting Financial Professionals

While this article provides comprehensive guidance, there might be instances where the "Chat Versailles credit card charge" is part of a larger, more complex financial issue. In such cases, don't hesitate to seek professional advice. Financial advisors, credit counselors, or even legal professionals specializing in consumer protection can offer tailored guidance. They can help you understand your rights, navigate complex disputes, and develop strategies for long-term financial security. Organizations like the National Foundation for Credit Counseling (NFCC) or local consumer protection agencies are excellent resources for unbiased, expert advice.

Encountering an unfamiliar "Chat Versailles credit card charge" can be unnerving, but it's a solvable problem. By systematically investigating the charge, understanding the potential causes, and knowing your rights as a consumer, you can effectively resolve the issue and protect your financial well-being.

Have you ever encountered a mysterious charge like "Chat Versailles" on your statement? Share your experiences and tips in the comments below – your insights could help others facing similar dilemmas. And if you found this guide helpful, consider sharing it with friends and family to empower them with the knowledge to safeguard their own financial health. For more articles on financial security and consumer protection, explore our other resources on the site.

Detail Author:

- Name : Teresa Koss IV

- Username : danika88

- Email : gaylord.wilkinson@hotmail.com

- Birthdate : 1975-06-20

- Address : 881 Lori Landing Apt. 986 Port Faustofurt, AL 99529

- Phone : 1-954-761-4934

- Company : Pacocha Group

- Job : Substance Abuse Counselor

- Bio : Error est quas voluptas vero voluptates explicabo aut. Sed fugiat autem et impedit et quae atque. Doloremque nobis repellat autem porro.

Socials

tiktok:

- url : https://tiktok.com/@lmitchell

- username : lmitchell

- bio : Eius velit possimus voluptas nostrum.

- followers : 566

- following : 196

facebook:

- url : https://facebook.com/lambert_dev

- username : lambert_dev

- bio : Et et est et et eius. Nulla culpa distinctio minima deserunt consequatur.

- followers : 5017

- following : 1237

instagram:

- url : https://instagram.com/lambert6270

- username : lambert6270

- bio : Veritatis aut dolorum officia sunt odit. Ducimus rem quo ea aut quod iusto vel.

- followers : 5214

- following : 1184